rhode island property tax rates 2020

Current and past tax year RI Tax Brackets. Rhode Island Property Tax.

How Do State And Local Sales Taxes Work Tax Policy Center

Johnston has a property tax rate of 2324.

. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. File Your Return Make a Payment Check Your Refund Register for Taxes. The median property tax in Rhode Island is 361800 per year based on a median home value of 26710000 and a median effective property tax rate of 135.

RI-1040H - Rhode Island Property Tax Relief Claim. The tax rates for the 2021-2022 fiscal year are as follows. Now may be the perfect time to purchase a home in one of those areas.

1 Rates support fiscal year 2020 for East Providence. Pensions Benefits Toggle child menu. Administering RI state taxes and assisting taxpayers by fostering voluntary compliance through education and ensuring public confidence.

Rhode Islands largest county by area and by population Providence County has the highest effective property tax rates in the state. 25 Dorrance Street Providence RI 02903 Room. You can look up your recent appraisal by filling out the form below.

On the flip side you will also find municipalities in Rhode Island where the property tax rates are trending down. Jamestown Residential median value. Tax amount varies by county.

Central Falls has a property tax rate of 2376. Rhode Island Towns with the Highest Property Tax Rates. The countys average effective property tax rate is 179 as compared with the state average of 153.

DO NOT use to figure your Rhode Island tax. Cranston City Hall 869 Park Avenue Cranston Rhode Island 02910 1-401-461-1000. 2016 Tax Rates.

Search Valuable Data On A Property. Woonsocket has a property tax rate of 2375. Assessment Date December 31 2019.

Tax Assessor HOME Tax Exemption Information FAQs Tax Assessor Forms Tax Rates File a Tax Appeal Public Legal Notices Annual Tax Assessors Notice Property Value QA. Rhode Island Property Tax Rates. Rhode Island has an effective property tax rate of 163.

3243 - commercial I and II industrial commind. The tax rates for the 2022-2023 fiscal year are as follows. State of Rhode Island.

Cassius Shuman - June 5 2020 1205 am. Rhode Island Division of Taxation. 41 rows West Warwick taxes real property at four distinct rates.

Counties in Rhode Island collect an average of 135 of a propertys assesed fair market value as property tax per year. SIGN UP FOR OUR WEEKLY. 1 to 5 unit family dwelling Residential Vacant Land.

6 unit apt. 2020 Rhode Island Property Tax Rates Hover or touch the map below for. Cranston City Hall 869 Park Avenue Cranston Rhode Island 02910 1-401-461-1000.

Providence has a property tax rate of 2456. Property Tax Cap. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily.

Rhode Island has one of the highest average property tax rates in the country with. Includes All Towns including Providence Warwick and Westerly. Visit us on Facebook.

Rhode Island Tax Brackets Rates explained. 3470 - apartments with six or more units. Ad Get In-Depth Property Tax Data In Minutes.

Monday - Friday 830am to 430pm. Rhode Island Municipalities Where Property Tax Rates Are Falling. FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020 Represents tax rate per thousand dollars of assessed value.

The 2022 Real Estate and Tangible Personal Property Tax Bills have been issued and are currently payable on-line or in person at 3027 West Shore Road. FY2023 Tax Rates for Warwick Rhode Island. February 19 2020 Reading Time.

2989 - two to five family residences. Little Compton Residential median value. 6 unit apt.

Though Rhode Islands property tax rates are high the state does offer some opportunities for exemptions and tax breaks. The exact percentage varies depending on your propertys location. That number has fallen considerably to.

FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial Industrial Real Estate - 2810Personal Property - Tangible - 3746Motor Vehicles - No motor. Quarterly PaymentDue DateNo interest through1July 15 2022July 31 20222October 15 2022 3January 15 2023 4April 15 2023 Please contact the Tax Collectors Office at 401 738-2002 if you have any questions. RRE Residential Real Estate COMM Commercial Real Estate PP Personal Property MV Motor Vehicles NOTES.

Re-ranked by 2020 median residential property value. Vacant land combination commercial structures on rented land commercial condo utilities and rails other vacant land. In 2020 the property tax rate for Exeter was 1557.

Start Your Homeowner Search Today. Visit us on Facebook. Instead if your taxable income is.

Office of the Governor RIgov. Counties in Rhode Island collect an average of 135 of a propertys assesed fair market value as property tax per year. Rhode Island Tax Brackets for Tax Year 2020.

FY2023 starts July 1 2022 and. Monday - Friday 830am to 430pm. City of Providence Tax Rates.

Such As Deeds Liens Property Tax More. West Greenwich has a property tax rate of 2403. As Percentage Of Income.

One Capitol Hill Providence RI 02908. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. Rhode Island Tax Table 2020 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 0 50 100 150 200 250 300 350 400 450 500.

Tax amount varies by county. New Shoreham Residential median value. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

1 to 5 unit family dwelling Residential Vacant Land. 135 of home value.

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

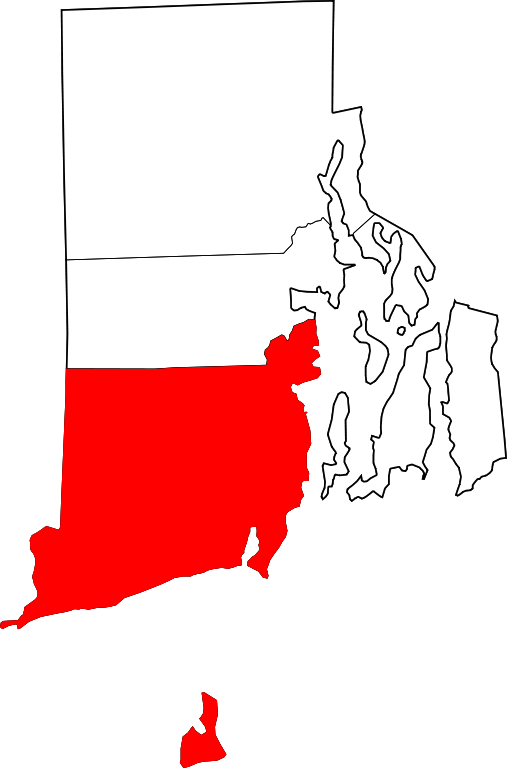

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

The 7 Most Affordable Places To Live On The East Coast Clever Real Estate East Coast Places Vacation Home

Property Taxes By State Quicken Loans

9368 Willowdale Rd Greencastle Pa 17225 Zillow In 2022 Built In Microwave House Styles Greencastle

N338 94 Billion Was Generated As Vat In Q1 Nbs Nigeria National Nigerian

10 States With No Property Tax In 2020 Property Tax Property Investment Property

Delaware State Univeristy Calander University Calendar Academic Calendar Delaware State

Cambridge Ma Real Estate Cambridge Homes For Sale Realtor Com Cambridge House Real Estate Estates

Property Taxes By State Highest To Lowest Rocket Mortgage

11 Field St 1 Cambridge Ma 02138 2 Beds 2 Baths Homeowner House Styles Redfin

Bhk Individual House For Sale In Kk Nagar Trichy Rei Bhalla Anime Modern Plans Spelle In 2020 Small House Elevation Design Architectural House Plans House Front Design

Property Taxes How Much Are They In Different States Across The Us

Council Post Show Me The Money Real Estate Revenue In The Modern Age Of Home Flippers Real Estate Investor Real Estate Trends Show Me The Money

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Income Tax Return

New York Property Tax Calculator 2020 Empire Center For Public Policy

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Consumer Alert As Home Values Soar Towns Consider Property Tax Relief Wjar

State Corporate Income Tax Rates And Brackets Tax Foundation